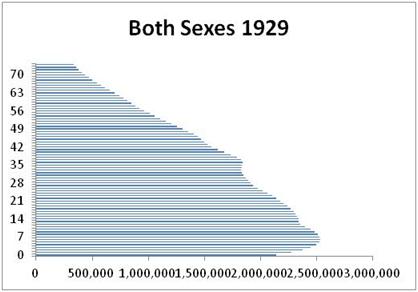

I posted this too soon. Here is a snapshot of the demographics of the USA in the last three episodes of monetary instability: 1929, 1975, 2009.

1975 looks far more like 1929 than either does like 2009. What is the explanation? That Milton Friedman’s lesson was taught in the interim? That the Gold Standard messed everything up? Not sure… Here’s Scott Sumner:

While campaigning for re-election in 1932, Herbert Hoover bragged that although the economy was looking a bit weak, voters could take comfort in the knowledge that his adroit leadership had preserved the dollar/gold peg. Soon after, that old regime was swept away by a political and economic tsunami.

That rhetoric suggests the politicians weren’t as beholden to the median-aged voter as they supposedly are today.

Hi.

1929 was a pretty different world in a lot of ways, along many more dimensions than age demographics.

Institutionally, in 1929, we were on an actively maintained gold standard. Intellectually, although the ideas were “out there” in some sense, Keynes and Fisher had not yet written, there was little policy experience with using fiscal and monetary policy to stabilize macroeconomies (as distinct from banking systems, which central banks had stabilized since the early 19th C).

Most importantly, the institution of “retirement” as we now know it did not exist as a mass phenomenon. Only the truly rich saved financial assets to endow a period of healthy leisure. Most working people worked pretty much until they could not. When they could not, they relied upon the support of their (working) children, rather than on a combination of the (not yet extent) Social Security and personal savings.

There was not a lump of old people in 1929, but even if there had been, I don’t think we’d have expected their political interests to be similar to what they are now. During the 1930s (as and famously during the 1890s, “cross of gold” speech and all of that), there was an active fight over “hard money” vs reflationary policies, but it was more directly class and interest-based, with rich people and stakeholders in (solvent, surviving) banks on one side, and debtors (e.g. farmers) on the other side. The interest of broader groups, of any age or category, strikes me as pretty hard to tease out.

I’m not sure I’d argue that the Great Depression was “chosen” in the way that I’d argue the current one is. Although interventions were always controversial and opposed by interests that had something direct to fear, the US political apparatus seemed pretty focused upon the Depression, and boldly activist with respect to trying solutions. What we now see as “mistakes” often were the result of a “hard money” constituency, but the politics behind that constituency strike me as pretty different. There were that era’s bankers and plutocrats, as there are in this era. There were (as there are now) elite political and intellectual dogmas regarding “sound finance”. But I don’t think that there was a mass constituency opposed to stimulatory policy analogous to today’s affluent retirees. And, in the Great Depression, we did have the WPA, the confiscation and repricing of gold, and the rest of the New Deal’s alphabet soup. The US democracy really was geared to “unchoosing” depression. It just didn’t quite succeed. Now it is not even trying very hard.

Thanks for the comment, Steve.

I find a lot of your points appealing but perhaps, taken as a whole, a bit too complex to really nail the case shut.

There is one similarity between The Great Recession and The Great Depression that I think supports the core of your story: debt levels were similarly very high then and now. And never in between.

It suggests that there was then and is now a political constituency of debt holders with awesome political strength relative to its historical baseline.